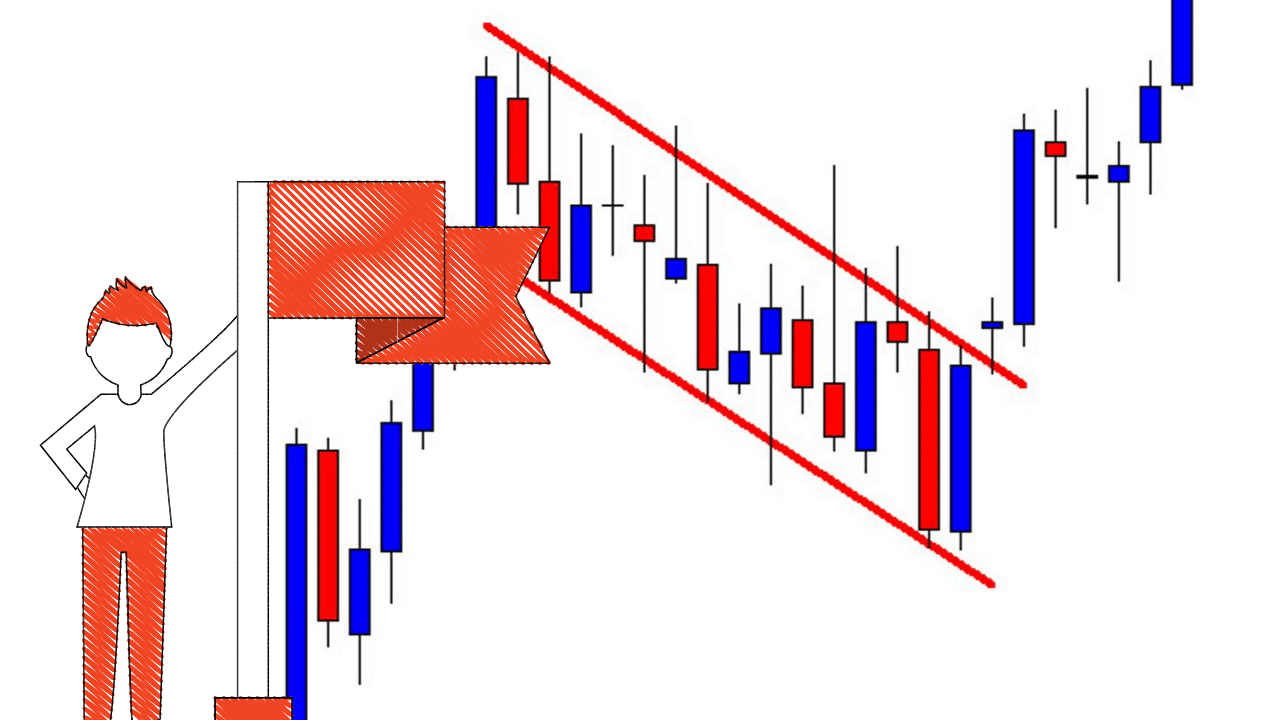

Following the steep rise, candlesticks contained in a small parallelogram by forming a flag pattern. The pattern begins with a pole formation, which represents a nearly vertical and steep price move. It is a trend continuation pattern that gets its name from its visual resemblance to a flag on a flagpole. In an ideal world, the two shoulders would be the same height and width. Volume is typically highest during the first two declines, and then decreases through the right shoulder. Many traders look for a significant increase in volume to confirm the validity of the breakout. A move above the resistance, also known as the neckline, is interpreted as a signal for a sharp upward move. The shoulders are formed by the first and third troughs, while the head is formed by the second peak.

Head-and-Shoulders & Inverse Head-and-Shoulders

The falling wedge usually precedes an upward reversal, which means you can look for potential buying opportunities.

It happens when the price makes lower highs and lower lows, forming two contracting lines. The falling wedge is a reversal pattern that appears during a downtrend. Depending on where it appears on a price chart, the falling wedge can also be used as a continuation or reversal pattern. That is why it is known as a continuation signal.Ī Falling Wedge is a technical bullish chart pattern that forms during an upward trend, with the lines sloping downward. The price broke lower, and the downtrend continued. Price began in a downward trend before consolidating and drawing higher highs and even higher lows. If it forms during a downtrend, it may indicate that the downtrend will continue. The support line has a sharp slope than the resistance line. This suggests that higher lows are forming faster than higher highs. If the rising wedge appears after an uptrend, it is typically a bearish reversal pattern. Price action forms new highs, but at a much slower rate than price action forms higher lows. Depending on where it appears on a price chart, the wedge pattern can be used as a continuation or reversal pattern. As and when the price consolidates between upward sloping support and resistance lines, a rising wedge is formed.

The rising wedge pattern is a technical bearish chart pattern that indicates a forthcoming downside breakout.

0 kommentar(er)

0 kommentar(er)